Reading the historic bull market in cattle futures. Will it continue?

"Reading the historic bull market in cattle futures. Will it continue?"

Image Source: Chat GPT

by Jim Roemer - Meteorologist - Commodity Trading Advisor - Principal, Best Weather Inc. & Climate Predict - Publisher, Weather Wealth Newsletter

Edited by Scott Mathews

- Weekend Report - August 9-10, 2025

(This posting is an excerpt from Jim Roemer’s WeatherWealth newsletter dated August 4th. His newsletters are followed by farmers and traders around the world to make better investment and hedging decisions, often before the crowd reacts. There is no obligation.)

In order to use Weather's power to “outsmart” competitors and to catch market moves, you can learn how by requesting a 2-week FREE trial to WeatherWealth by just clicking HERE

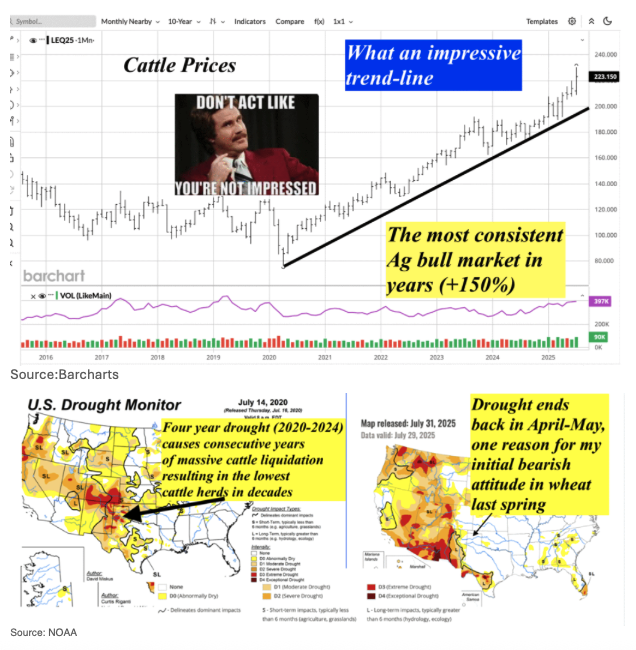

Why the weather created the new bull market in cattle

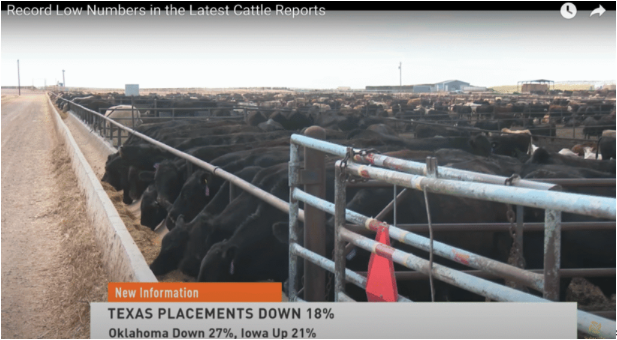

Cattle supplies began to plummet following three straight years of droughts in Texas (#1 producer) from about 2020-2023. That and stellar demand for beef and recent Trade Tariffs have helped prices soar. This trend-line is unlike any other in the Ag commodity space.

With improved pasture conditions from Kansas to Texas, it is possible there may be a slow rebuilding of herds in 2026. That might be longer term bearish, later, but I am not sure.

Image Source: Farm Journal/Ag Web - used by permission

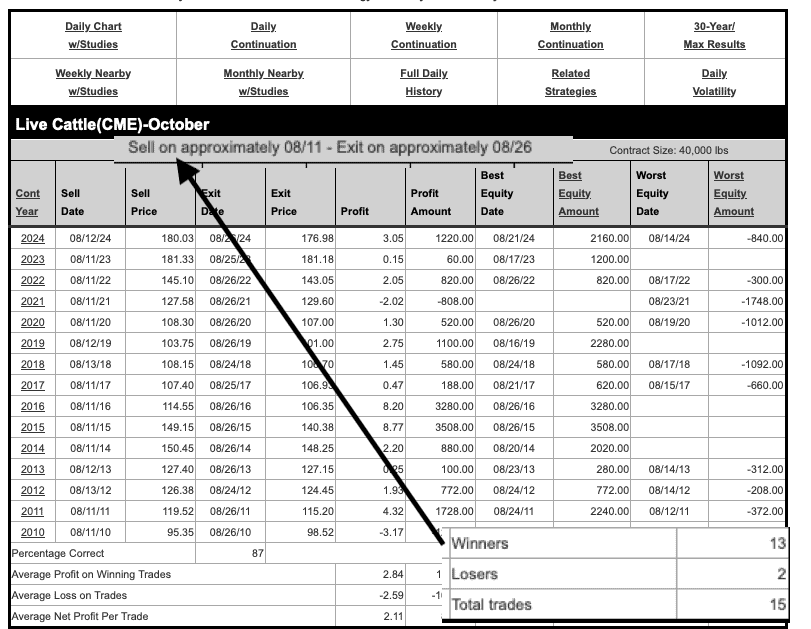

Source: Moore Research (MRCI) - used by permission

Conclusion: Cattle

Cattle prices tend to go lower for about 10 days in Mid-August and may be a short term sell. It is possible, however, that the end of the southern Plains drought could rebuild cattle herds in 2026 and be bearish. For now, the US cattle supply continues to shrink. Hence, use technical analysis to trade this market. If we fall below the longer-term trend line, that would obviously be bearish for the typIcal chartist.

Thanks For Your Interest In Commodity Weather!!!

Jim Roemer, Scott Mathews, and the BestWeather Team

Mr. Roemer owns Best Weather Inc., offering weather-related blogs for commodity traders and farmers. He is also a co-founder of Climate Predict, a detailed long-range global weather forecast tool. As one of the first meteorologists to become an NFA registered Commodity Trading Advisor, he has worked with major hedge funds, Midwest farmers, and individual traders for over 35 years. With a special emphasis on interpreting market psychology, coupled with his short and long-term trend forecasting in grains, softs, and the energy markets, he commands a unique standing among advisors in the commodity risk management industry.