Walsh Grain Market Opportunities - Pure Hedge Division

The grain markets have been very slow lately, but there is still opportunity if you use options. If you think the grains can shoot higher from here, or if you think they sink lower, I have trades for you to look at below. I have strangles in the soybeans, corn and wheat. You are buying premium only, so 0 margin issues. If the grains have a big price swing, the trades below with capitalize on the price movement. If you do not think the grains will do much for the next few months, as the trade deals have not helped, and we are near contract lows, there is a trade below for you as well. If you sell a call and a put at the same strike, you are selling a straddle. When you sell a straddle, you want the futures price to stay within a range and allow the option premium to erode overtime. When you buy a strangle you are looking for a large price movement in either direction. There are examples of each below in the grain markets. There is risk involved selling a straddle or buying a strangle, but there is risk in everything. Give me a call if you have any questions. Have a great weekend.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

Please consider the following trades:

SOYBEANS

NOVEMBER ’25 SOYBEANS WERE $9.88 WHEN THESE TRADES WERE STRUCTURED

STRANGLE:

Buy 1 November ’25 1060 Call 8

Buy 1 November ’25 940 Put 8 5/8

Price: 16 5/8 Cost: $831.25/Trade Package, Plus Fees and Commissions

MAXIMUM LOSS: LIMITED – CAN ONLY LOSE PREMIUM PAID – ZERO MARGIN RISK

STRADDLE:

Sell 1 November ’25 1010 Call 18 1/4

Sell 1 November ’25 1010 Put 23 1/4

Price: 41 1/2 Credit Cost: $2,075 Credit, Plus Fees and Commissions

MAXIMUM LOSS: UNLIMITED

Straddle Range: 1067 3/4 High end, 952 1/4 Low end

The trade above is looking for a slow down or range bound market movement.

JANUARY ’26 SOYBEANS WERE $10.06 3/4 WHEN THESE TRADES WERE STRUCTURED

STRANGLE:

Buy 1 January ’26 1080 Call 12 5/8

Buy 1 January’26 920 Put 6 3/8

Price: 19 Cost: $950/Trade Package, Plus Fees and Commissions

MAXIMUM LOSS: LIMITED – CAN ONLY LOSE PREMIUM PAID – ZERO MARGIN RISK

The trade above is looking for a large price movement, not direction.

STRADDLE:

Sell 1 January ’26 1010 Call 33 3/8

Sell 1 January ’26 1010 Put 36 5/8

Price: 70 Credit Cost: $3,500 Credit, Plus Fees and Commissions

January 26’ Soybean Options Expire 12/26/25 (147 Days)

MAXIMUM LOSS: UNLIMITED

Straddle Range: 1081 1/4 High End, 938 3/4 Low End

The trade above is looking for a slow down or range bound market movement

CORN

DECEMBER ’25 CORN WAS $4.11 WHEN THESE TRADES WERE STRUCTURED

STRANGLE:

Buy 1 December ’25 440 Call 5 7/8

Buy 1 December ’25 380 Put 5

Price: 10 7/8 Cost: $543.75/Trade Package, Plus Fees and Commissions

December ’25 Corn Options Expire 11/21/25 (112 Days)

MAXIMUM LOSS: LIMITED – CAN ONLY LOSE PREMIUM PAID – ZERO MARGIN RISK

The trade above is looking for a large price movement, not direction.

STRADDLE:

Sell 1 December ’25 420 Call 10 1/2

Sell 1 December ’25 420 Put 19 5/8

Price: 30 1/8 Cost: $1,506.25 Credit, Plus Fees and Commissions

December ’25 Corn Options Expire 11/21/25 (112 Days)

MAXIMUM LOSS: UNLIMITED

Straddle Range: 1081 1/4 High End, 938 3/4 Low End

The trade above is looking for a slow down or range bound market movement

Wheat

DECEMBER ’25 WHEAT WAS $537.00 WHEN THESE TRADES WERE STRUCTURED

STRANGLE:

Buy 1 December ’25 580 Call 12 3/8

Buy 1 December ’25 500 Put 10 1/8

Price: 22 1/2 Cost: $1,125/Trade Package, Plus Fees and Commissions

December ’25 Wheat Options Expire 11/21/25 (112 Days)

MAXIMUM LOSS: LIMITED – CAN ONLY LOSE PREMIUM PAID – ZERO MARGIN RISK

The trade above is looking for a large price movement, not direction.

STRADDLE:

Sell 1 December ’25 550 Call 21 5/8

Sell 1 December ’25 550 Put 33 3/8

Price: 55 Credit Cost: $2,750 Credit, Plus Fees and Commissions

December ’25 Wheat Options Expire 11/21/25 (112 Days)

MAXIMUM LOSS: UNLIMITED

Straddle Range: 604 High End, 496 Low End

The trade above is looking for a slow down or range bound market movement

Call for active trade recommendations in any other markets.

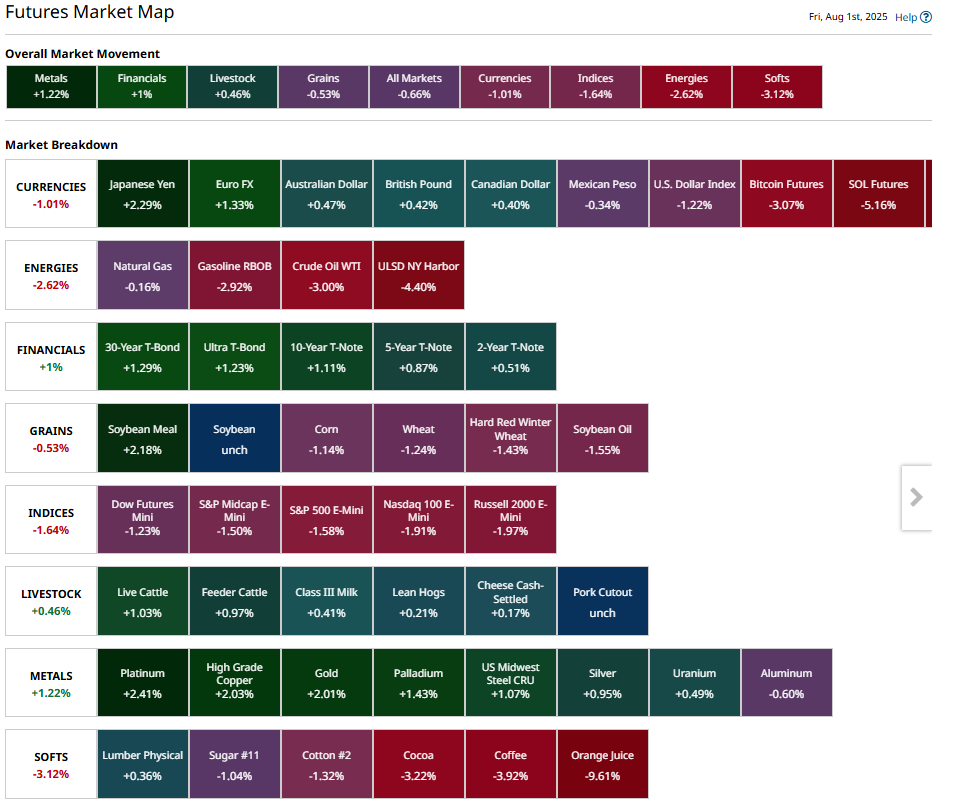

The need for a successful business to have a trading account is immeasurable. Look at the market movement in all markets over the last three weeks. Opening an account sometime in the future will not help you if you need access now. To be successful, and able to manage risk, you need to be proactive now and secure your access to markets in real time. You can be both prepared and patient at the same time. WATCH FOR TRADE DEAL NEWS.

If you like this article and would like to receive more information on the commodity markets, please use the link to join our email list

If you’re ready to start trading, click the link below to open an account with Walsh Trading, Inc.

Hans Schmit, Walsh Trading

Direct 312-765-7311 Toll Free 800-993-5449

[email protected] www.walshtrading.com

Walsh Trading

311 S Wacker Suite 540

Chicago, IL 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.